With the rise of stablecoins, cryptocurrency cards have become the trend as of the time of writing and for good reason. There are plenty of young adults these days with some crypto exposure and this is one of the easier ways to spend crypto directly.

You can of course withdraw them via exchanges but this is an alternative way of spending.

Here’s how you can get a crypto card in Malaysia with KAST card. There are many types of crypto payment cards these days but not all of them can be used or issued in this country.

Disclaimer: The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. Do your own research and never invest more than you can afford to lose.

How to obtain a cryptocurrency debit card in Malaysia

As mentioned above, there are many types of crypto cards these days. Some are issued from crypto exchanges while others are more of payment platforms with some backing from big names.

One of the crypto card companies that have come up a lot on social media is KAST which is why I decided to try it.

Basically, how it works is that you have to download the KAST app on your mobile phone and sign up there. The downside for some people is that you need to KYC (know your customer) if you wish to sign up for the card. Not everyone in crypto wants to KYC for sure.

Once you’re done signing up, you can then send some crypto to the KAST’s internal wallet (I’ll assume you know how to send crypto to an address correctly). You will immediately get a virtual card upon signing up and it can be used with certain platforms (e.g. linked to Apple Pay).

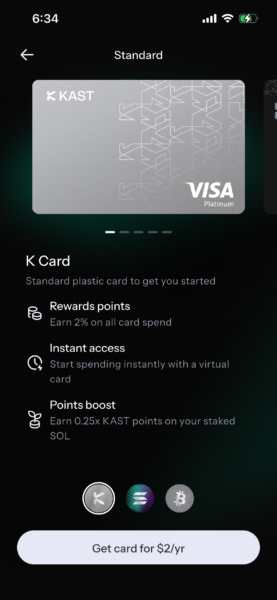

With the funds in the internal wallet, you can also apply for a physical card. The lowest tier card is cheap (free or almost free depending on promotion) and it goes way higher after that. It can even cost up to $10k USD per year in fees for one of the top-tier gold cards. For the lowest tier card, it may take 1 – 2 weeks for delivery in Malaysia, and much longer for certain card designs or tiers.

This card will probably be issued outside of Malaysia so it’s treated as an international debit card. At the moment, it seems like it’s partnered with Visa.

If you’re spending crypto in a currency other than USD, there are also FX fees to be aware of.

Where can you use the KAST crypto card?

As mentioned before, KAST cards seem to be partnered with Visa at the moment and it’s usable in shops accepting Visa, which is almost everywhere in Malaysia.

Basically, how KAST card works is that it allows you to spend crypto that you sent to the app’s internal wallet. If you wish to only use it virtually, you don’t need to apply for a physical card. You can link the virtual card to Apple Pay or perhaps to some other payment system.

If you’re using a physical card, you can use it just like a debit card at merchants. Just use the PayWave system in Malaysia and for transactions above the PayWave limit, you need to use your signature as well, the same way foreigners use their international card.

Some risks to be aware of

While having a crypto card is very convenient, there are always risks associated to it. One of the more obvious risks is that your funds have to be moved to their internal wallet inside the app, so you may not have control over the funds. This is why it’s better to put an amount you’re fine losing in case something happens or your account gets suspended.

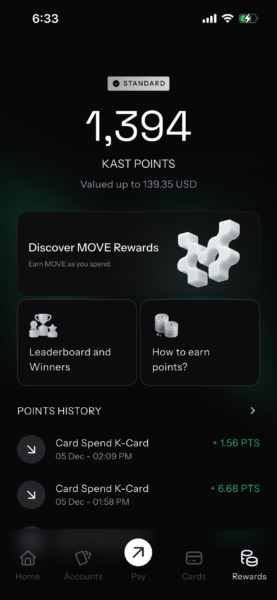

You will also find a rewards section for the card. Many crypto cards these days offer cashback with different rates. KAST claims to offer cashback as well but it’s not an actual cashback, at least not in the conventional sense. What it does is that it gives you points for card usage and the points are supposed to be redeemed for actual KAST tokens at a later date. This is a risk you have to be aware of since you’re not getting actual cashback but rather points which may or may not be worth anything at a future date.

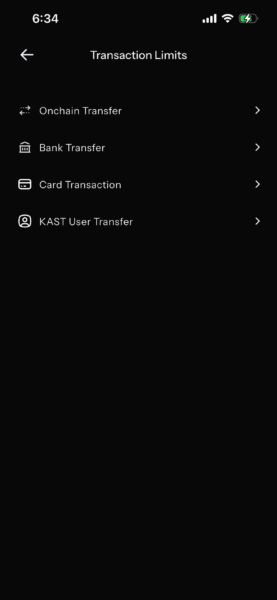

The daily transaction limit for transfers, card usage and so on are all on the app itself. You should adjust the daily limit first to suit your needs. If it gets stolen someone else can empty your wallet if your limit is too high.

It’s also advisable not to flaunt a crypto card around, knowing how many crypto holders have been victims of crime lately.

These are some of the more obvious risks, apart from the usual risks you come across in the cryptocurrency industry. Stay safe.